georgia estate tax rate 2020

As we previously reported the maximum Georgia income tax rate was temporarily reduced to 575 effective for tax year 2019 down from 60. Tax rate of 2 on taxable income between 751 and 2250.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

2020 Georgia State Sales Tax Rates The list below details the localities in Georgia with differing Sales Tax Rates click on the location to access a.

. Georgia collects gasoline taxes of 287 cents per gallon of regular gasoline. For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes. GEORGIA SALES AND USE TAX RATE CHART Effective October 1 2020 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

Reduction of the Levy Rate of Business Registration. The state income tax rates range from 1 to 575 and the general. The median property tax in Georgia is 134600 per year for a home worth the.

Tax rate of 1 on the first 750 of taxable income. 2020 Georgia State Salary Examples. General Rate Chart - Effective January 1 2020 through March 31 2020 1878 KB General Rate Chart - Effective October 1 2019 through December 31 2019 1877 KB General.

In a county where the millage rate is 25 mills the property tax on. Georgia has six marginal tax brackets ranging. With local taxes the total sales tax rate is between 4000 and 8900.

Georgia state taxes 2020-2021. Georgia GA Sales Tax Rates by City. Detailed Georgia state income tax rates and brackets are available on this page.

Georgia has a 400 percent state sales tax rate a max local sales tax rate of 490 percent and an average combined state and local sales tax rate of 735 percent. Inside the City of Atlanta in both DeKalb County and. The Peach States beer tax of 101 per gallon of beer is one of the highest nationally.

How to Figure Tax. While income and sales taxes are the ones that apply to most taxpayers the state also charges a 575 percent corporate tax rate on Georgia businesses as well as property. The Georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2022.

GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2020 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below. The Georgia state legislature will determine. For single taxpayers living and working in the state of Georgia.

This increases to 3 million in 2020 mississippi. The assessed value 40 percent of the fair market value of a house that is worth 100000 is 40000. Waiver Period from 142020 to 3132021.

2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier. Waiver Period from 142019 to 3132020. 2021 list of sales and use.

Georgias tax system ranks. The state sales tax rate in Georgia is 4000. The georgia ga state sales tax rate is currently 4.

Obtain your Georgia State Tax. To successfully complete the form you must download and use. Georgias income tax rates were last changed two years prior to 2020 for tax year 2018 and the tax brackets were previously changed in 2009.

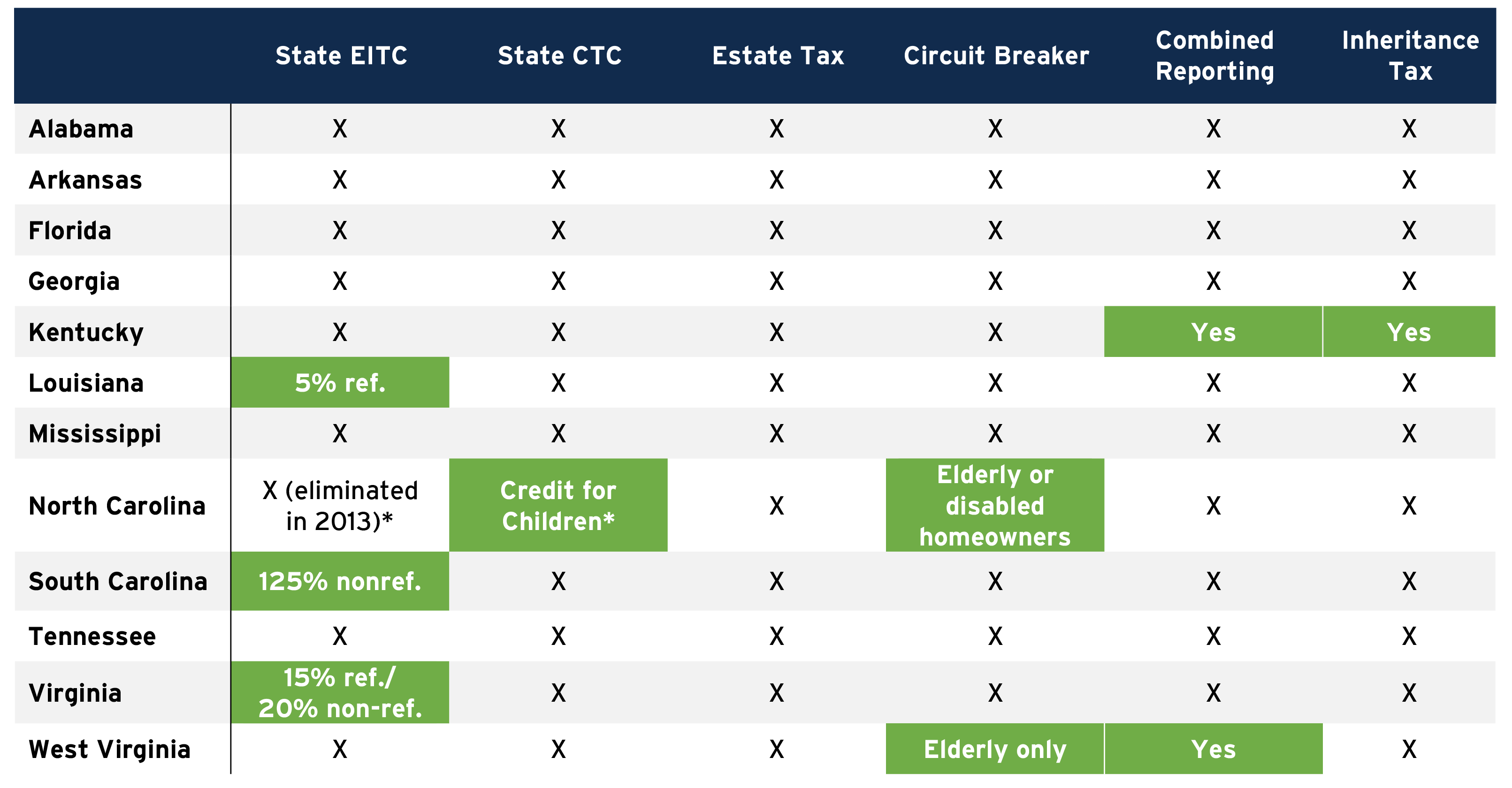

Creating Racially And Economically Equitable Tax Policy In The South Itep

Understanding Gift Taxes Georgia Estate Plan Worrall Law Llc

State By State Estate And Inheritance Tax Rates Everplans

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

State Taxation As It Applies To 1031 Exchanges

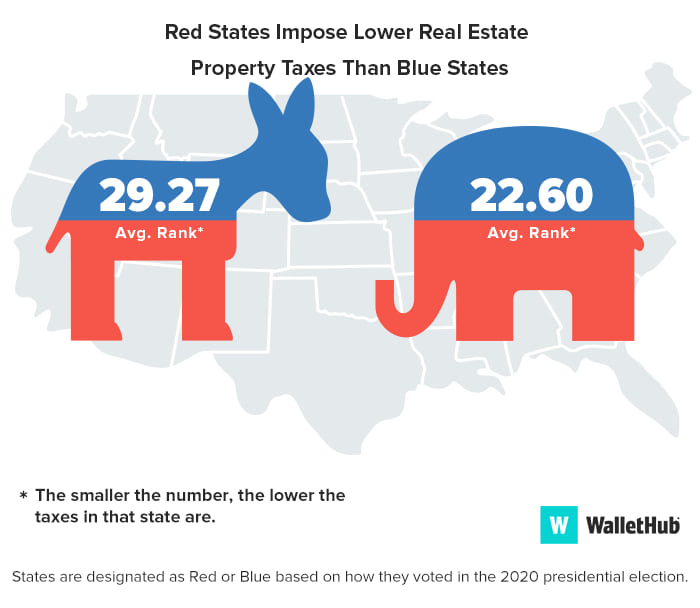

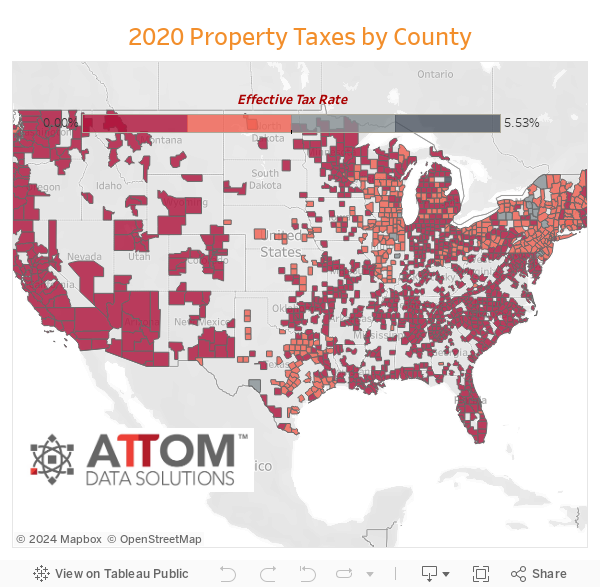

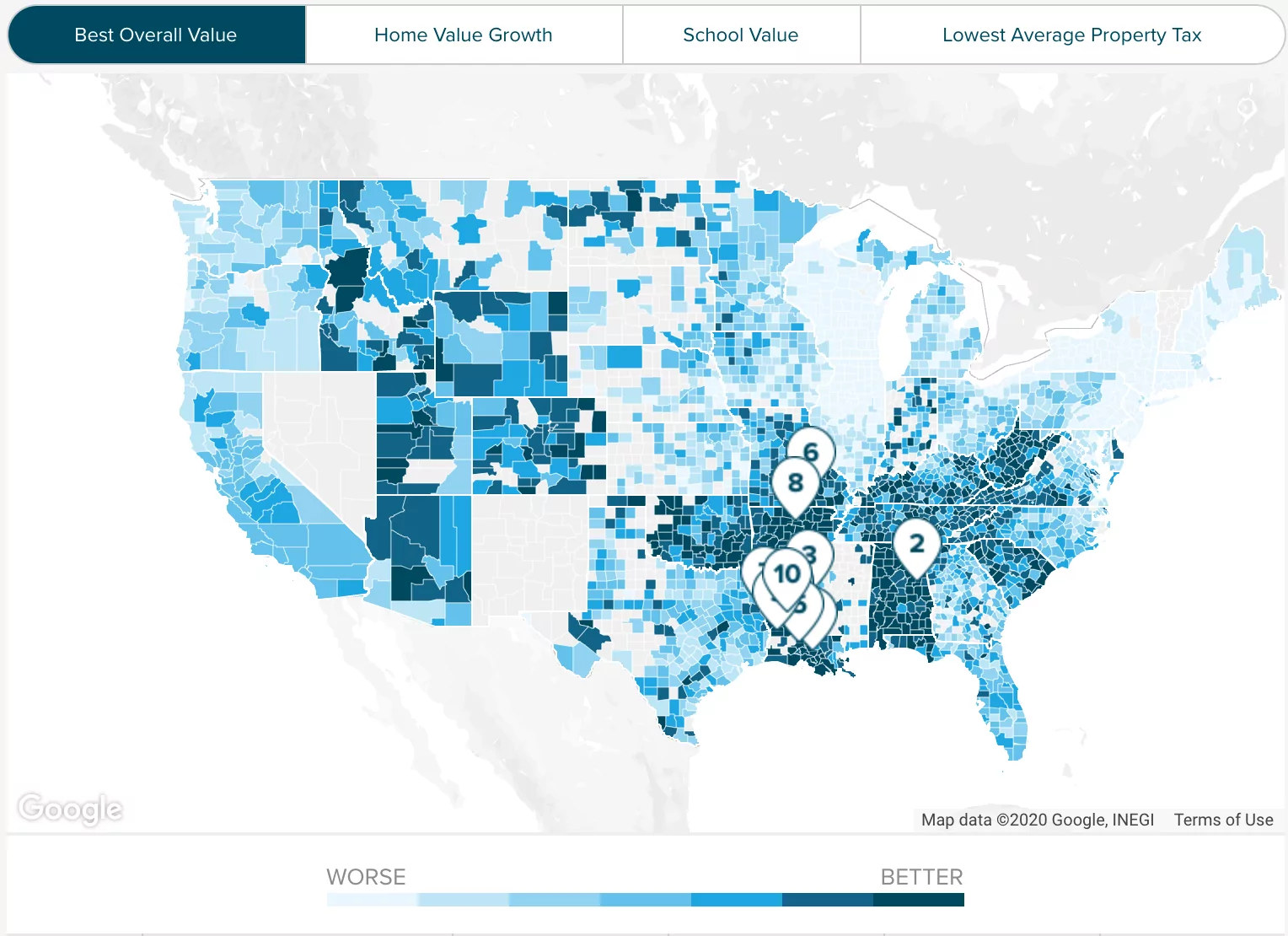

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

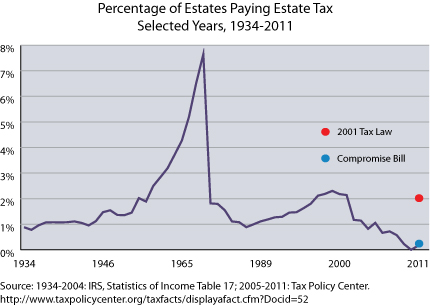

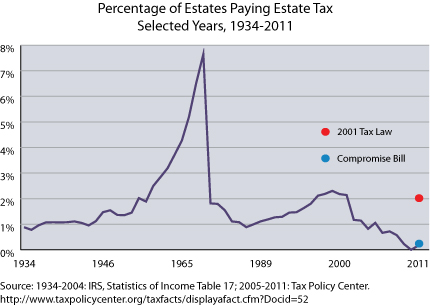

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

2022 Property Taxes By State Report Propertyshark

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Planning 101 Your Guide To Estate Tax In Georgia

Exploring The Estate Tax Part 1 Journal Of Accountancy

Dekalb County Ga Property Tax Calculator Smartasset

Estate Taxes Are A Threat To Family Farms

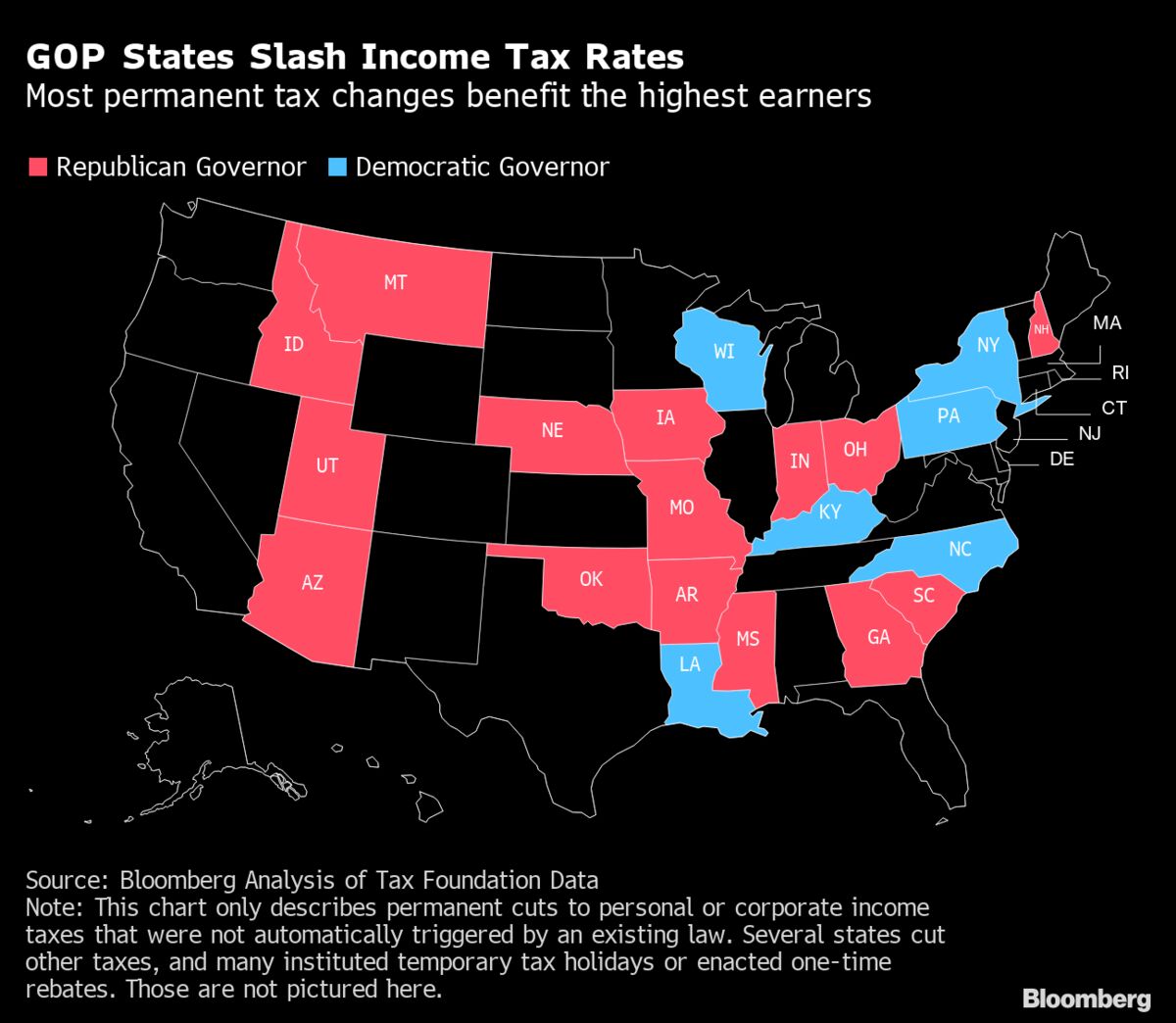

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

State Death Tax Hikes Loom Where Not To Die In 2021